michigan gas tax increase history

Cent of tax was 466 million. Although the sales tax is not imposed upon.

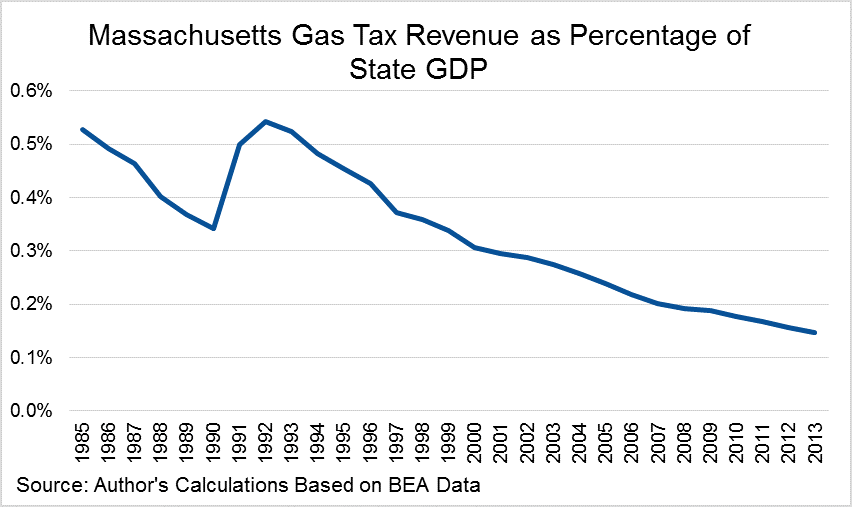

Massachusetts Ballot Referendum Challenges Gas Tax Indexing Tax Foundation

Federal excise tax rates on various motor fuel products are as follows.

. The state excise tax is 75 cpg on gas and diesel additional 138 ppg state sales tax on diesel 118 ppg state sales tax on gasoline. The Federal gasoline tax 184 cents per gallon the Michigan sales tax levied at a rate of 60 on a base that includes the. And the states gas tax as a share of the total.

Whitmer proposed a 45-cent gas tax increase to help fix Michigans crumbling roads. The goal Whitmer said. 1 thanks to a change in the law added by the Legislature to.

In Michigan three taxes are included in the retail price of gasoline. Is A Michigan Gas Tax Increase Inevitable. But you also pay the Michigan 6 percent sales tax.

The exact amount of the 2022 increase will depend on the inflation that occurs between Oct. With the mid-year tax rate increase gasoline tax revenues were up 2696 million from the prior fiscal year. Repealed 1947 PA 319.

This week Gov. Added Chapter 2 Diesel Fuel Tax to 150 PA 1927 at 6 cents per gallon. Michigan gas tax increase history Thursday May 19 2022 Edit.

1 2020 and Sept. Per MCL 2071010 the owner of motor fuel held in bulk storage where motor fuel tax has previously been paid to the supplier at the lower rate would owe the difference. Gas prices will be the most expensive ever for the holiday.

So far in 2021 inflation has been unusually high. 1 2017 as a result of the 2015 legislation. Michigan fuel taxes last increased on Jan.

Mar 25 2020. Didnt gas taxes just go up. Effective January 1 2017 the motor fuel rate which.

By Jack Spencer February 2 2013. Michigans gas prices up about 17 cents a gallon over last week alone continue to rise. Rick Snyder has made road funding his top 2013 agenda item and theres been some talk of lawmakers.

Gas and Diesel Tax rates are rate local sales tax varies. Raise the 19-cents-gallon gasoline tax and 15-cent diesel tax by 73 cents and 113 cents to 263 cents starting in 2017. Gretchen Whitmer proposed a 45-cent gas tax increase that would be phased in over two years in three increments.

Michigans Democratic Gov. Increased Gas Tax rate to 45 cents per gallon. Michigan motorists should be prepared to see the state gasoline and diesel fuel tax increase by about 33 on Jan.

For the unfamiliar American Electric Power is the name behind AEP Ohio Kentucky Power Public Service Company of Oklahoma Indiana Michigan Power and a. As of January of this year the average price of a gallon of gasoline in Michigan was 237. Effective January 1 2022 the gas tax in Michigan climbed to 0272 per gallona 33 increase from the previous years gas tax rateand its expected to rise again.

Despite Recent Price Increase Gas Prices 1980 - May 2000 Figure 1 GASOLINE PRICES AND TAXES IN MICHIGAN by David Zin Economist. Experts are uncertain when prices will decline. Chart The Population Rank Of Every U S State Over 100 Years Go West Young Man And Infographs Pop.

The tax on regular fuel increased 73 cents per gallon and the. This is an increase of 83 over 2021 bringing travel volumes almost in line with those in 2017. The Center Square State gas taxes and fees in Michigan amount to 42 cents per gallon the ninth highest rate among the 50 states according to an analysis by the website 247 Wall St.

Michigans net annual spending increase will total 825. 0183 per gallon. Increased Motor Carriers Fuel Tax rate to 21.

Regular gas was 434 in Michigan on.

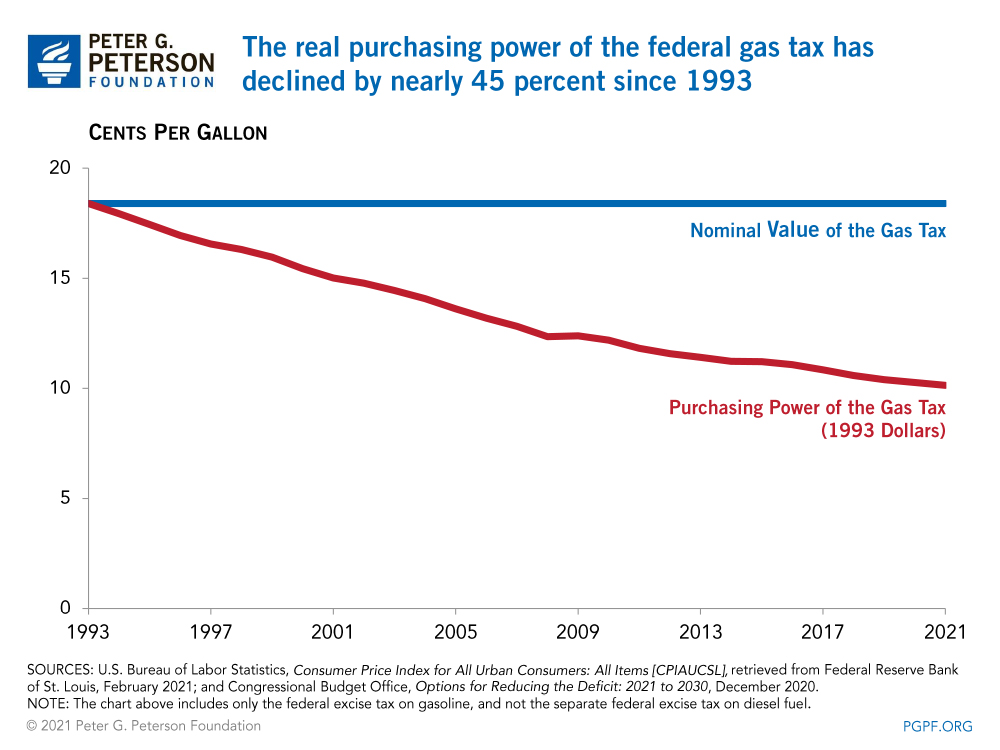

It S Been 28 Years Since We Last Raised The Gas Tax And Its Purchasing Power Has Eroded

Gov Wolf Proposes Pa S Biggest Tax Increase Ever But It Would Be A Tax Cut For Many Pennlive Com

Rising Price Of Fuel In Michigan Makes Gas Tax Hike A Tough Sell

Michigan Gas Tax Hike Coming In 2022

How Long Has It Been Since Your State Raised Its Gas Tax Itep

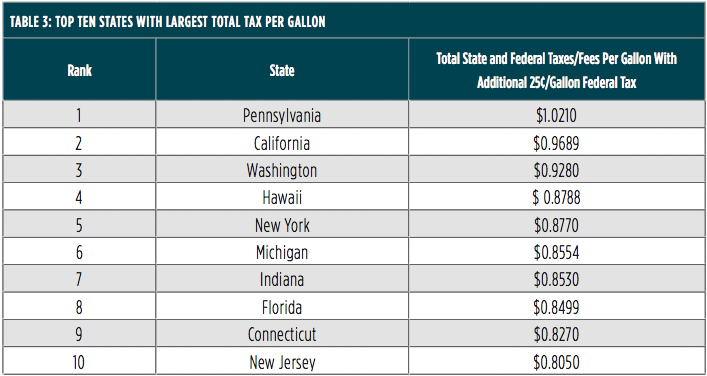

Every American Stands To Lose Under Unprecedented Gas Tax Increase

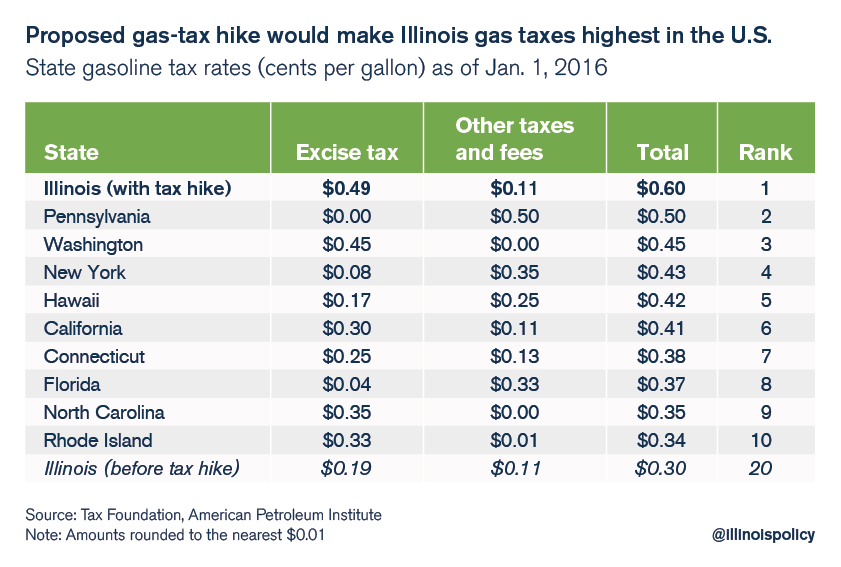

New Bill Would Make Illinois Gas Taxes Highest In The Nation

Vehicle Miles Traveled Vmt Tax Highway Funding Tax Foundation

Indiana Gas Taxes On Brink Of State Record Transport Topics

Chicago Drivers To See Third Gas Tax Increase In 18 Months

Gov Whitmer Proposes Raising Gas Tax By 45 Cents To Fund Michigan S Crumbling Roads Mlive Com

Michigan Gas Tax Going Up January 1 2022

Michigan Gasoline And Fuel Taxes For 2022

Michigan Governor Gretchen Whitmer Proposes Gas Tax Increase

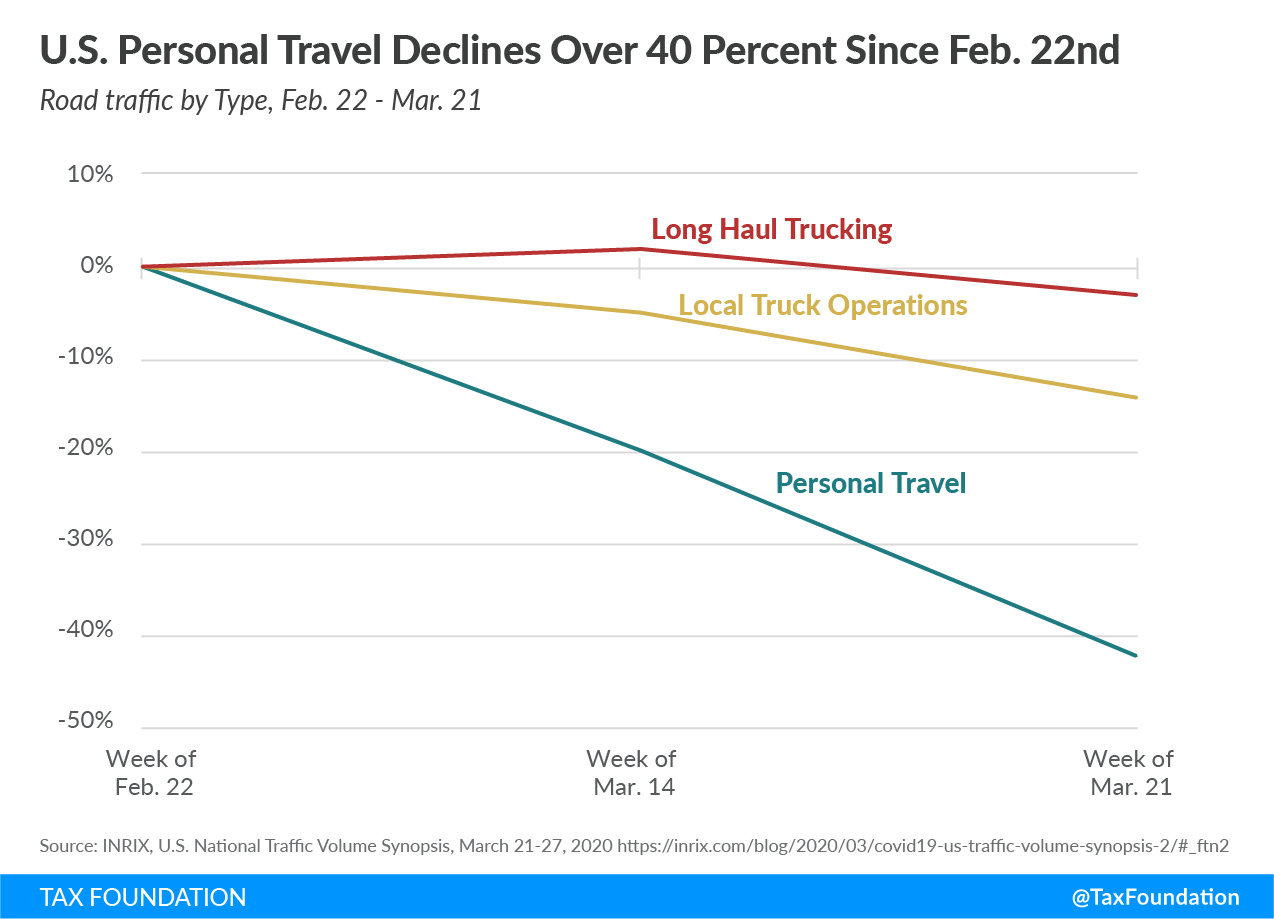

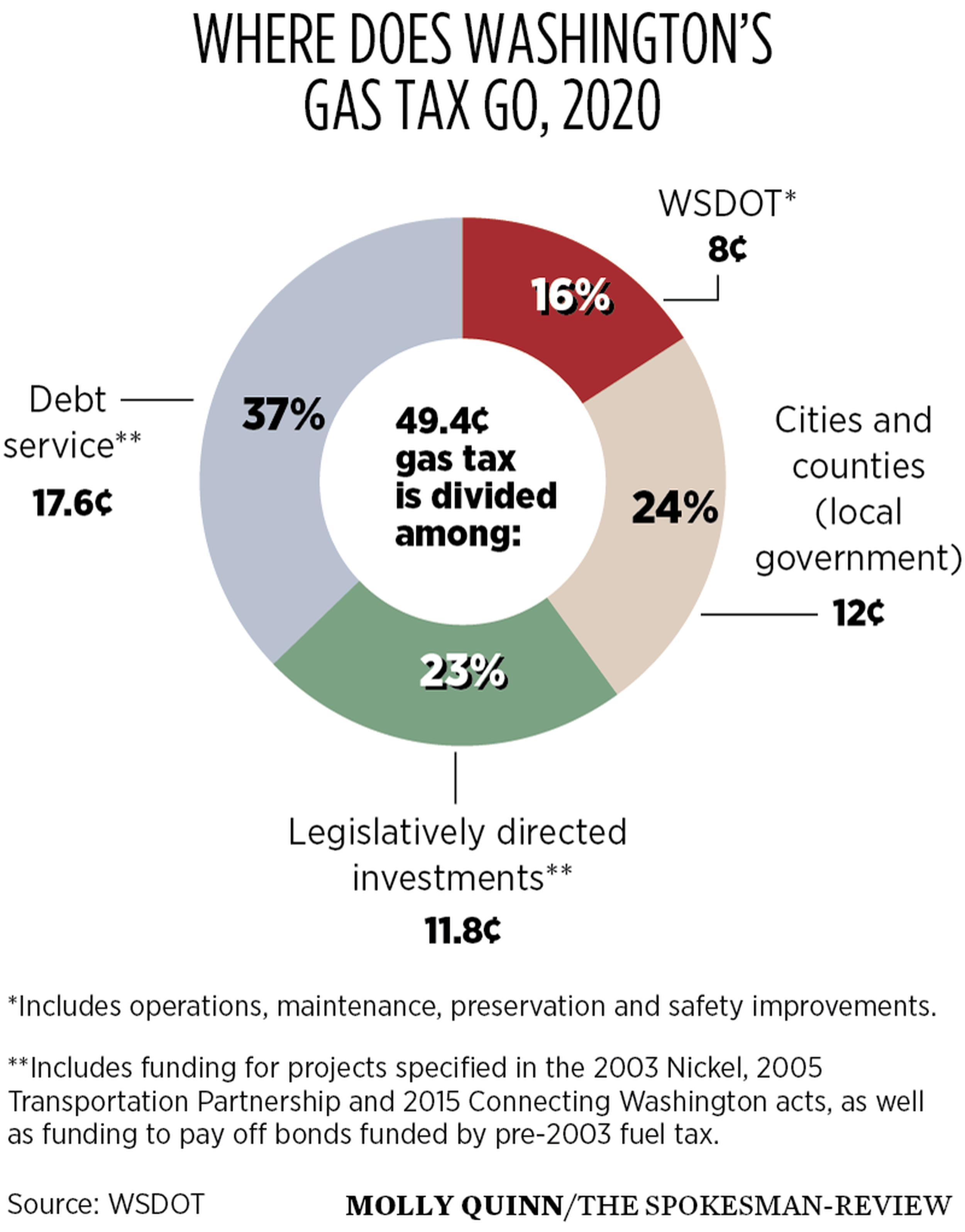

Getting There As Gas Tax Revenue Drops Washington Department Of Transportation Could Face 40 Funding Decline Delay Projects The Spokesman Review

Michigan Gas Tax Going Up January 1 2022

The Pros And Cons Of Higher Gas Taxes And How They Could Be Offset For Lower Income Families Massbudget

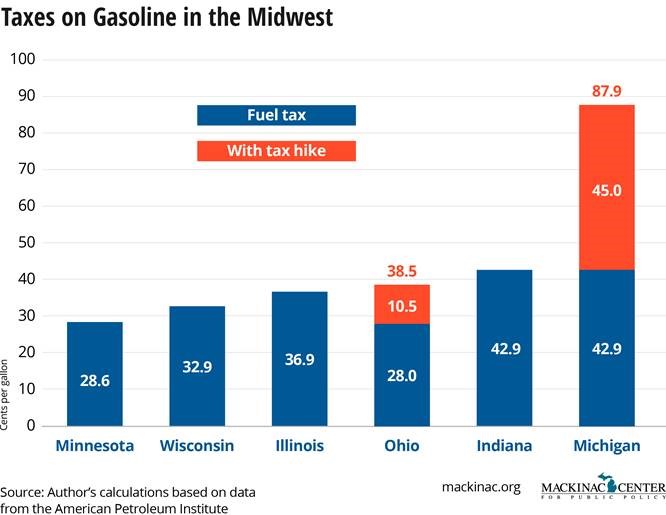

We Re No 1 Michigan Could Get Nation S Highest Gas Tax Michigan Capitol Confidential